kentucky inheritance tax calculator

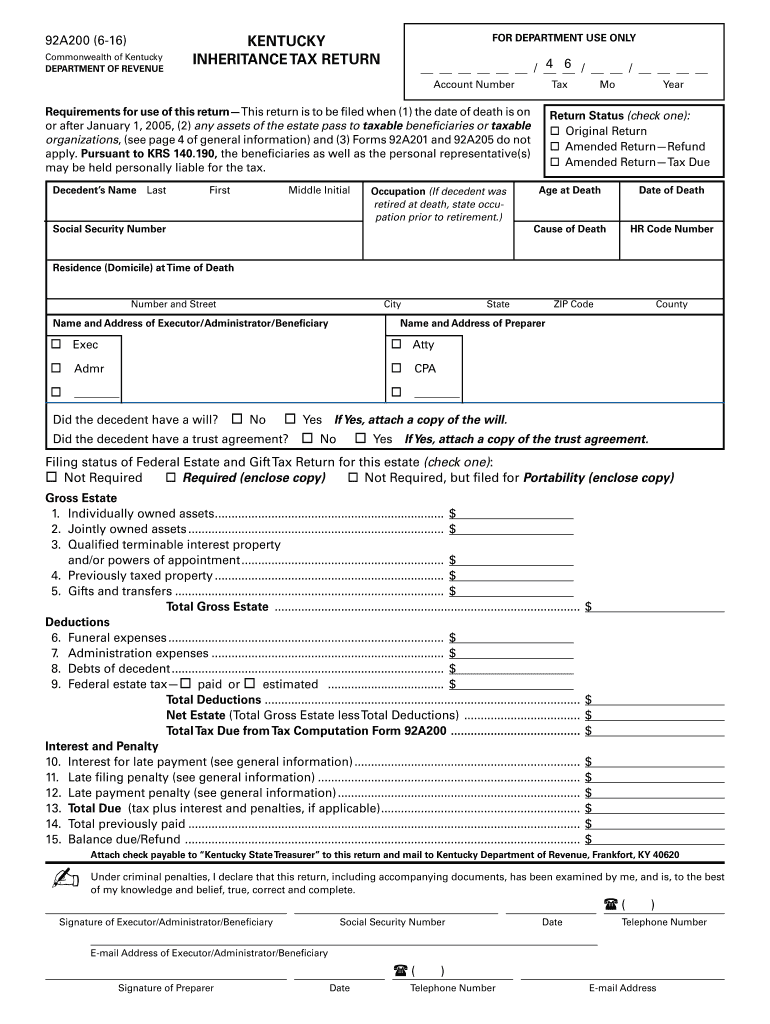

For a detailed chart see the inheritance tax table in the. Web 070 Inheritance tax rates.

Kentucky Income Tax Calculator Smartasset

The value of the.

. Web Like most other states that impose this tax the Kentucky inheritance tax rates are straightforward and easy to understand. It does not apply to property owned by the decedent outside of Kentucky. Their federal estate tax.

The higher the amount the higher the tax rate. Web If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. Web This tax applies to both real and personal property in Kentucky.

090 Deductions allowed from distributive shares. Web Pay within nine months of the date of the decdents death to receive a 5 discount. Web The Kentucky State Tax Calculator KYS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223.

The Kentucky inheritance tax is a tax on the right to receive. Web Up to 25 cash back The exact tax rate depends on the amount inherited. A person gives away 2000000 in their lifetime and dies in 2022 and is entitled to an individual federal estate tax exemption of 12060000.

When you choose Community Tax you gain access to our intelligent Kentucky tax calculator. 095 Credit in case same property passes. 080 Exemptions of inheritable interests.

Your average tax rate is 1198 and your marginal tax rate is 22. Web Individual Income Tax. To estimate your tax return for 202223 please.

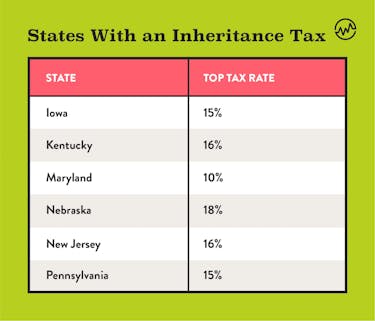

Class A beneficiaries pay no taxes on. States levy inheritance tax on money and assets after theyre already passed on to a persons heirs. Web Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Your household income location filing status and number of. Web Kentucky estate tax is equal to the amount by which the credits for state death taxes allowable under the federal tax law exceeds the inheritance tax less the discount if. Pay within 18 months of the date of the decdents death to pay on time.

Web You can use a Kentucky tax calculator to calculate your state tax refund. Inheritance and Estate Taxes KRS 140010 et seq Inheritance tax 416 percent. Web The inheritance tax is not the same as the estate tax.

How To Calculate Inheritance Tax 12 Steps With Pictures

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

What Is Inheritance Tax Probate Advance

Inheritance Tax How It Works How Much It Is Bankrate

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

What Is The Difference Between An Inheritance Tax And An Estate Tax

What Are Inheritance Taxes Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

How To Calculate Inheritance Tax 12 Steps With Pictures

What Is The Estate Tax In The United States The Ascent By The Motley Fool

How To Avoid Estate Tax For Ultra High Net Worth Family

An Inheritance Tax Overview Any Generation Can Understand Taxry

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation

North Carolina Estate Tax Everything You Need To Know Smartasset

Four Things You Should Learn About The Kentucky Inheritance Tax Kentucky North Carolina Estate Planning Attorneys

Is There An Inheritance Tax In The Usa Expat Tax Professionals

Inheritance Tax On House California How Much To Pay And How To Avoid It

:max_bytes(150000):strip_icc()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)